(585) 546-1470 • Habitat@GRHabitat.org • 755 Culver Road, Rochester, NY, 14609

Own your own home

A decent and affordable home is the foundation to build your future.

Becoming a Habitat Homeowner

Homeownership

The Habitat Homebuyer Program consists of sweat equity, educational classes, and community service — all designed to prepare you for homeownership.

Helping build Habitat homes, monthly budgeting/reporting, and homeowner education classes (including financial literacy, home safety, and home maintenance) will make you confident in your ability to maintain your home for years to come.

Eligibility to purchase a Habitat home is based on the three qualifications.

“I want to thank God for the blessing of this home, for without Him none of this would be possible. This process has taught me patience and persistence, because when I was just about to give up, I was approved for this home. I am grateful to Habitat, my sponsors and all that were involved with this process and for giving me this opportunity.”

Darlene M.

New Paragraph

Qualifications for Homebuyer Program

1) Ability to Pay

Habitat homebuyers must have a steady source of income that is within income requirements for your household size. You must also maintain good credit. We run an initial credit report for qualification and also monitor credit quarterly while you work towards homeownership.

2) Demonstration of Need

If your housing situation includes one or more of the following examples, you may be eligible to purchase a Habitat for Humanity home.

- Substandard: Examples may include broken plumbing, faulty or unsafe electrical service, poor heating, deteriorating structure, or any other health and safety issue.

- Cost burdened: Rental payments are 35% or more of your total income.

- Overcrowded: If an adult and child, more than two children, or two children of the opposite sex share a bedroom.

3) Willingness to Partner

Willingness to partner is your household’s commitment to provide consistent, dedicated work to the Greater Rochester Habitat for Humanity program. Examples include:

- Single applicants must complete a minimum of 200 sweat equity hours, 100 of which must be performed on a Habitat construction site.

- Dual applicants must complete a minimum of 300 sweat equity hours, 150 of which must be performed on a Habitat construction site.

- Homebuyers must attend financial literacy and other required educational classes.

- Homebuyers must meet with your volunteer coach at least once

per month.

- Homebuyers must provide proof of income and savings once a month.

- Homebuyers are required to provide $3,000 towards the closing costs of the home and will be expected to achieve this goal while completing program requirements.

- Homebuyers must make on time monthly home mortgage payments.

- Homebuyers must maintain and repair the home after occupancy.

***Homebuyers must acknowledge the implications of a highly publicized program. Homeowner should be prepared to share their story through in-person communications, area media (e.g., newspaper, radio, internet) and GRHFH publications (e.g., photos, videos, audio recordings) if requested. Note: not all projects will be publicized, and in extenuating circumstances when safety and privacy are a primary concern, GRHFH will work with the Partner(s) to determine what is appropriate to be made public.

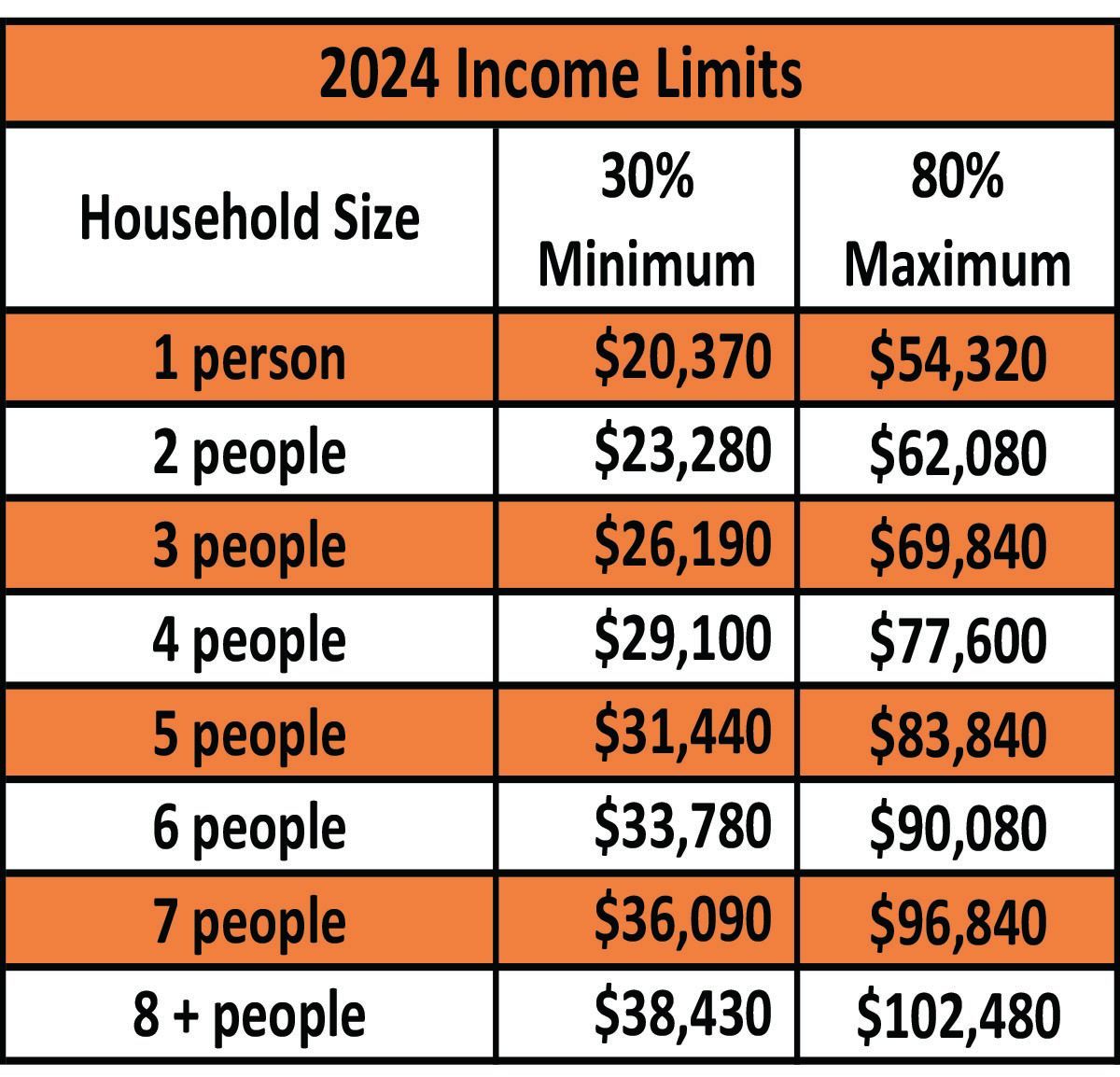

Determining your Household income: First identify your household size. This is the total number of people who would be living in the Habitat home should you be accepted to the program. Then, identify the total GROSS income for the entire household. This is any earned wages before tax deduction, all SSI or SSD, and any income from self-employment, child support, pension, or survivor benefits for everyone that is part of the household. Once you have that number, find your household size on the chart below, and identify your income bracket.

New Paragraph

Homeward Bound

Our Homeward Bound program is the first step for anyone who does not currently meet all of the requirements for our Homebuyer Program. With the help of partnering agencies, we will develop a plan with you that will get you on the path to homeownership.

Homeward Bound participants are able to attend educational classes, track and improve their credit score, and volunteer with us.

All efforts that are completed during Homeward Bound are transferable towards Homebuyer Program requirements.

Stay informed

Sign up to get the latest news, volunteer opportunities, and other ways to get involved with Habitat for Humanity.

Flower City Habitat for Humanity DBA Greater Rochester Habitat for Humanity is a 501(c)(3) non profit recognized by the IRS. Tax Id Number 13-3281487.